The term Exempt Market Dealer (often abbreviated to “EMD”) is a firm that has been licensed to distribute investment securities exempted from the prospectus requirement based on the rules and regulations of each province where the EMD is registered to carry on business.

Often referred to as ‘private capital’, these investments are often not publicly traded like listed stocks and securities.

EMD is required to be licensed and registered with local provincial security commissions. An EMD has regulated standards that Securities and our Dealing Representatives make sure they know their investments, know their clients, maintain appropriate knowledge and proficiencies, resolve complaints in a timely fashion, carry reasonable insurance, and most importantly, treat their clients “fairly, honestly, and in good faith”. These are the pillars that MCF Securities was founded on, and we take our responsibilities to investors very seriously.

For MCF Securities, we are registered in Ontario, British Columbia, Nova Scotia, Alberta, Saskatchewan and Prince Edward Island as an Exempt Market Dealer and all our Dealing Representatives are accordingly registered in their respective jurisdictions.

Hedge funds are alternative investments using pooled funds that employ different strategies to earn active return, or alpha, for their investors. Hedge funds may be aggressively managed or make use of derivatives and leverage in both domestic and international markets with the goal of generating high risk-adjusted returns (either in an absolute sense or over a specified market benchmark). It is important to note that hedge funds are generally only accessible to accredited investors.

Each hedge fund is constructed to take advantage of certain identifiable market opportunities. Hedge funds use different investment strategies and thus are often classified according to investment style. There is substantial diversity in risk attributes and investments among styles. There are hundreds of different hedge fund strategies. Each one works differently and derives value differently.

Yes. Many of the investments that MCF Securities distributes can be purchased into a registered plan. As part of our objective of bringing private capital investing to Canadian retail investors, we work with many of our issuers to create platforms that qualify for registered plans under the Income Tax Act (Canada).

In Canada, the companies you invest with are not allowed to issue securities unless they file a prospectus, which can be a very expensive process and significantly increase the cost of capital. Because it’s so expensive, most Canadians think of Fortune 500 companies when they think of investing.

Private capital investments are different, because they can be purchased with an exemption from the prospectus requirement. These exemptions give Canadians access to a unique investment class that acts and performs differently than the traditional investments that most retail investors hold in their portfolios. It’s a strategy that many institutional investors* have been relying on for years to help disassociate a portion of their portfolio away from some of the systemic risks of freely trading stocks and bonds. Private capital investments can allow investors to acquire tangible assets and specialized capital in unique investment opportunities.

To buy private capital on the “exempt market” you have to qualify for an exemption from the prospectus requirement that typically applies to distributions. Your MCF Securities dealing representative can help you determine whether or not you qualify for one of these exemptions.

Once you have been qualified, your MCF Securities dealing representative has the expertise to help you determine whether or not an investment is suitable for you. They will provide you with a list of investments that we have reviewed and approved for distribution through our channel and help you understand the pros and cons of each, as well as how to put techniques like diversification to use as a way of mitigating risk.

Private capital market offers a lot more varieties of investments to investors as it is no longer limited to public issuers. High net worth investors usually demand more investment varieties when constructing investment portfolio to diversify and to take advantages of the unique benefits offer by different types of investments. Private capital market investments are an essential component of high net worth investors and institutional investors.

Companies usually experience the highest growth before they go public. Private capital market allows investors invest in businesses in their high growth stage and could provide more attractive return than equity investments in public market.

Overall performance of the private capital market is often different than that of public capital market. Investing in private capital market could enhance diversification of investors investment and therefore decrease risks of the overall portfolio.

We would love to hear from you! We are here for you if you

have any questions in general.

Disclaimer: The contents on this website (the “Site”) are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument. The information contained in the Site does not constitute investment advice and should not be used as the basis of any investment decision. Any investment in MCF Securities distributed products must be based on the information contained in that product’s offering documents. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. The opinions expressed accurately reflect the views of MCF Securities as of the date hereof and, while their opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice.

The investor testimonials appearing on the Site reflect the experiences of individuals who invest in our products and/or services. However, individual results may vary. We do not claim, nor should the reader assume, that any individual experience recounted is typical or representative of what any other investor might experience. Testimonials are not necessarily representative of what anyone else invest in our products and/or services may experience.

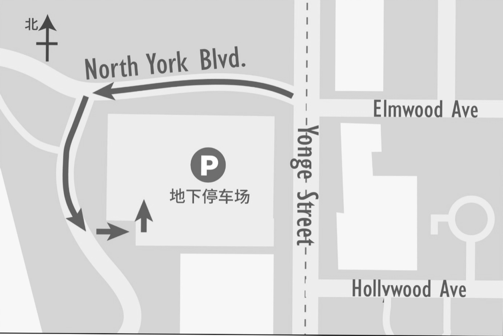

P in the map below is the parking lot.