Private real estate funds provide exposure to real estate with steady cash flow and attractive return uncorrelated to equity market. Leveraging professional real estate operating companies, investors could enjoy the benefits of owning real estates with a peace of mind.

Similar to private real estate funds, REIT investors could enjoy the attractive return from real estate exposure without the hassle to operate themselves. In addition, REIT usually provides better liquidity and higher annual distribution than private real estate funds.

A MIC is a company invest in mortgages only and mainly generates return from interest earned on mortgage loans. Backed by underlying real estate, MICs provide predictable steady return through different market conditions.

Private equities provide investors access to the return generated from private companies before their public offerings. The return is uncorrelated to public market performance and could improve the diversification of your portfolio, hence lower the overall risk level. Companies usually grow faster before they become public companies, therefore provide higher return to investors.

Venture capital provide essential financing to startups in their early or growth stage. In return, investors could share the value increase comes with exponential growth through innovation in technology and or business model.

Fund of funds invest into a pool of funds with different strategies. Designed to achieve diversification and benefit from selected strategies, fund of funds could be a one-stop solution for investors who want to have a diversified portfolio that perform under all market conditions.

Hedge funds utilize one or more investment techniques and could invest in a wide range of assets. With flexibility that mutual funds do not have, hedge funds design their unique investment strategies to achieve higher risk-adjusted return and to be consistent regardless of market conditions.

PPN is a financial instrument issued and backed by large financial institution that provides exposure to the performance of certain market, such as stocks, bonds, interest rate and currency market, while protects your principal. PPN is particularly suitable to investors who want to have their principal protected but are not satisfied with the return of GICs.

Tax incentives oriented strategies are designed to leverage the tax incentives provided by the government as an enhancement of return. As tax incentives are independent to market condition, tax incentives oriented strategies could provide higher risk-adjusted return to investors.

Our responsive team provides business owners professional advice to help you navigate complex corporate finance decision-making. From deal structuring to fundraising through our extensive distribution network, we are here to help your business grow.

We would love to hear from you! We are here for you if you have any questions in general.

Disclaimer: The contents on this website (the “Site”) are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument. The information contained in the Site does not constitute investment advice and should not be used as the basis of any investment decision. Any investment in MCF Securities distributed products must be based on the information contained in that product’s offering documents. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. The opinions expressed accurately reflect the views of MCF Securities as of the date hereof and, while their opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice.

The investor testimonials appearing on the Site reflect the experiences of individuals who invest in our products and/or services. However, individual results may vary. We do not claim, nor should the reader assume, that any individual experience recounted is typical or representative of what any other investor might experience. Testimonials are not necessarily representative of what anyone else invest in our products and/or services may experience.

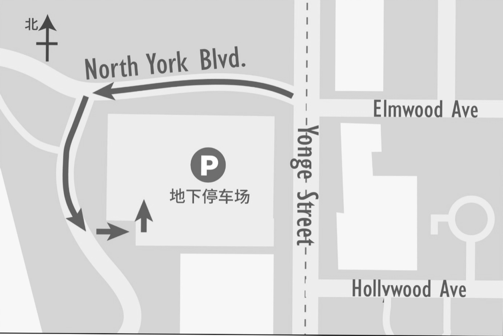

P in the map below is the parking lot.