OSC Exempt Market Report 2020

- 10/20/2021

In December 2020, Ontario Securities Commission (OSC) released a report reviewing the capital raised in Ontario through prospectus exemptions since 2017. Capital raised through prospectus exemptions are also knowns for names as “private placement” or “private capital market”, which is also the segment of capital markets where securities can be sold without a prospectus.

In this report, OSC reviewed the private capital market activities in Ontario between 2017 to 2019. It provided a snapshot of key trends in Ontario’s exempt market in different aspects including Market Composition, Annual Trends, Investor Trends, and Issuer Trends. Below are some highlights we picked from the report:

Market Composition

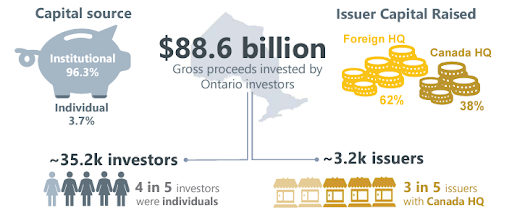

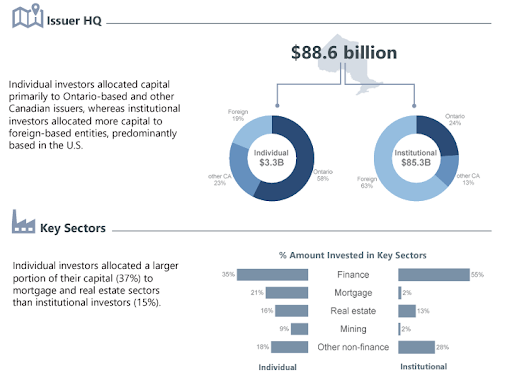

- During year 2019, $88.6 billion gross proceeds are raised from Ontario investors though private capital market.

- Approximately ~35,200 investors participated in Ontario private capital market in 2019. 25% of them are institutional investors and 75% are individual investors.

- Institutional investors accounts for a disproportionately large share of the capital raised. 96.3% of the capital raised are sourced from institutional investors, although they only accounts for 25% of the market participants. The remaining 75% individual market participants provided only 3.7% of the capital raised.

- Finance remains the largest sector for private capital where 54% of the capital raised are allocated to it. The second largest sector is Real Estate and Mortgage where 16% of the capital raised are allocated to the sector.

Annual Trend

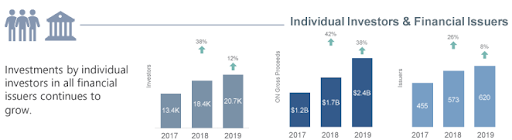

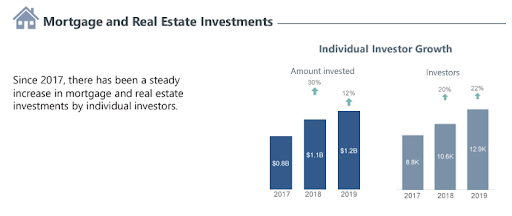

- While total annual proceed slightly decreased from 2017, individual investors increased over the last two years.

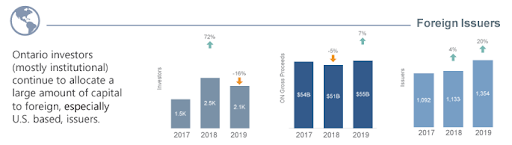

- Ontario investors, mostly institutional continues to allocate a large amount of capital to foreign countries, especially U.S.

Investor Trend

- Individual investors allocated capital primarily to Ontario-based and other Canadian issuers, whereas institutional investors allocated more capital to foreign-based entities, mostly U.S.

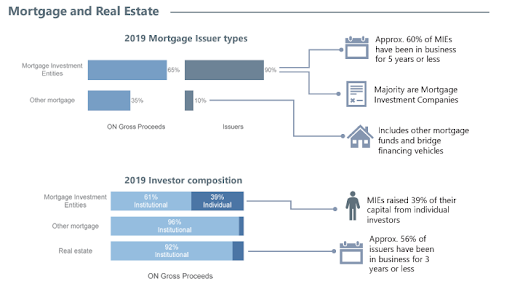

- Finance, Mortgage and Real Estate are the three largest sectors for capital raised. However individual investors allocated more capital (37%) to mortgage and real estate sectors than institutional investors (15%).

- There has been a steady increase in mortgage and real estate investment by individual investors since 2017.

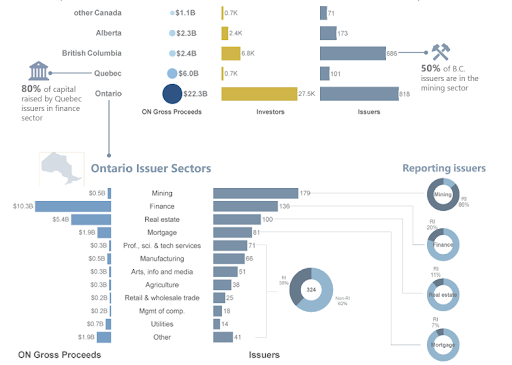

Issuer Trend

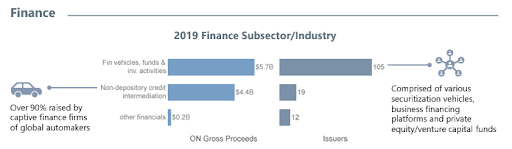

- Finance sectors continue to comprise the largest portion of the capital raised among Ontario-based issuers ($10.3B in total).

- Among the Finance subsector, 55% of the capital raised are issuers comprised of various securitization vehicles, business financing platforms and private equity/venture capital funds; and 38% of the capital are raised by captive finance firms of global automakers.

- Real Estate and mortgage are the second and third largest sector for Ontario private capital market issuers ($7.3B in total).

- Similar to other sectors, majority of the capital raised in the Real Estate and Mortgage sector are from institutional investors, 92% for the real estate sector and 61% for the mortgage investment entities.

Please find the below link to the full OSC Exempt Market Report 2020:

https://www.osc.ca/en/securities-law/instruments-rules-policies/4/45-717/osc-staff-notice-45-717-ontarios-exempt-market